Deciding to retire to Virginia Wine Country is an excellent choice, one that will offer you many enjoyable experiences. Knowing what you want in your retirement is only the first step, though. Next is evaluating your investing life, so we spoke with Sean Miller of Miller Asset Solutions on how best to prepare and manage your wealth for retirement.

You have likely thought about it—that the ideal retirement is the ability to do what you want, when you want, with whom you want and for as long as you want—but perhaps you have not put it directly into words. However, this priceless freedom in a Vineyard Retirement in Virginia is not costless. Your investment assets need to provide for your time at everything from the vineyards to local horse racing events. To do so, you need to prudently understand the following benefits: time in the market; risk; and fees.

VIRGINIA WINE COUNTRY RETIREMENT TIP #1: TIME IN THE MARKET

Time in the market beats timing the market. There will be times (like the current) where the market seems overvalued and you want to run for the hills (liquidate your portfolio) and drink wine. This is not prudent, because if you missed the market’s best 30 days over the last 20 years, you would have given up all positive total returns. If you missed just 50 of the best days over 20 years, your portfolio would have declined by 60 percent. The graphic below further illustrates the benefit of maintaining long-term market exposure, in that the longer the time frame, the more positive your investment returns become.

A SNAPSHOT OF THE S&P 500: 1926–2020

TIME FRAME

Daily

1 Year

5 Years

10 Years

20 Years

POSITIVE

56%

75%

88%

95%

100%

NEGATIVE

44%

25%

12%

5%

0%

VIRGINIA WINE COUNTRY RETIREMENT TIP #2: EVALUATE YOUR RISK

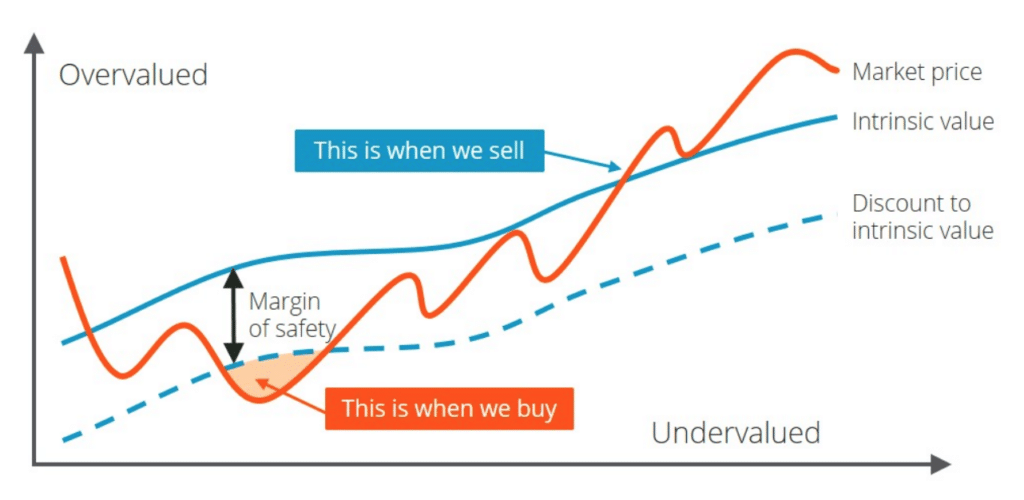

As you sip wine at the vineyards, you do not want to be plagued by thoughts of portfolio losses. Focus on how much of your portfolio you would like to be subject to general equity market risk (generally 60–70 percent). Now, focus on that percentage of your portfolio generating above-market returns. How? The best way to make money is by not losing it, and to take advantage when risk becomes mis-priced. An investment practice called the “Margin of Safety” can prevent you from losing money, and thus decreases risk. Pioneered by Benjamin Graham, the “Margin of Safety” is simply the practice of purchasing securities at prices sufficiently below their underlying value to allow for human error, bad luck or extreme volatility in a complex, unpredictable and rapidly changing investment market. Margin of Safety is all about price where you buy BELOW the underlying (or intrinsic) value of the security. The margin between the price you purchase the security at and the expected intrinsic value is the buffer that allows you to make money by not losing money. See the below graphic.

Estimating a security’s expected intrinsic value is the hard part. It is literally impossible for anyone (including the most astute and experienced investors in the market) to be able to determine the exact intrinsic value of a business. This is because the intrinsic value is generally based on assumptions and assumptions are often incorrect. Nevertheless, estimating a margin of safety of approximately 30 percent will give you a certain amount of protection and allow room for error in light of the many fluctuations that could occur under current market conditions.

A good application example of the Margin of Safety concept applies to bridge building. Engineers build bridges to hold three-times the estimated capacity of the expected traffic weight load. If the expected traffic weight load is 10 tons, then engineers build a 30-ton bridge and the difference of 20 tons is the Margin of Safety.

Investment advice and portfolio management are not priced like wine. When one purchases wine, it is perceived that the more expensive the wine costs, the better the wine must taste. This, though, has been proven to be untrue in blind taste tests over and over again…

VIRGINIA WINE COUNTRY RETIREMENT TIP #3: HOW TO PAY LOWER FEES

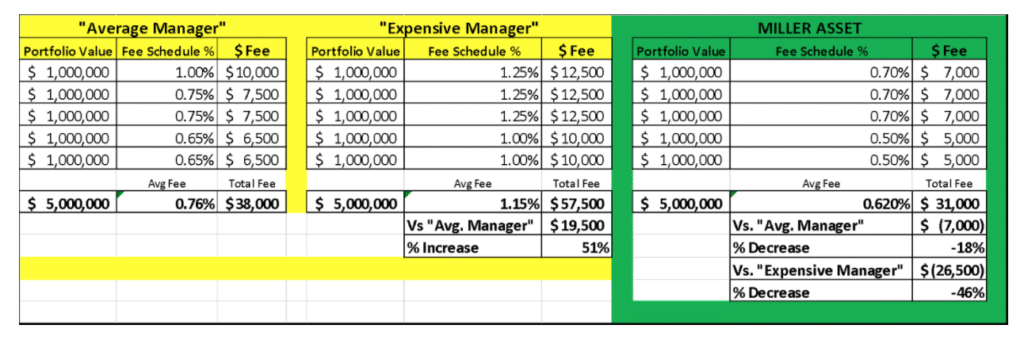

Managing your own portfolio is a wise decision if you have the skills and demeanor. Otherwise, folks outsource portfolio management to professional investment managers. Investment managers charge fees and lower fees are important, as they eat into investment returns and, ultimately, decrease the amount of wine you can purchase. Lower fees offer an immediate, risk-free return (you get something for nothing). You can only lower fees by (a) asking your current manager to lower your fees or (b) switching managers. It is my well-researched belief that fees of other “Average Managers” will not only never go down but also likely increase due to their greed and need to support large (and largely unnecessary) staffs. “Expensive Managers” fees are higher than “Average Managers” fees, as these expensive managers are usually banks or investment managers owned by banks or insurance companies (the last place you want your money managed).

The graphic above shows the fees on a $5-million portfolio of an “Average Manager” and an “Expensive Manager” versus my firm. I use $5 million as the amount only to illustrate the changes in each fee schedule from $1 million to $5 million. For example, “Average Manager’s” fee schedule charges 1 percent on the first $1 million, 0.75 percent on the next $2 million, then 0.65 percent on the next $2 million. For a $5 million portfolio, this would equal approximately $38,000 in annual fees. Applying the same math to “Expensive Manager’s” (higher) fee schedule, the annual fees would be approximately $57,500, or $19,500 (51 percent) more than the “Average Manager” fees. At my firm, the fees would be significantly lower. Potential savings at my firm would include $7,000 per year from “Average” fees and as much as $26,500 from “Expensive” fees. The reality is twofold in that (a) you don’t have to pay high fees for smart advice and (b) a great many folks are overpaying for investment advice.

Investment advice and portfolio management are not priced like wine. When one purchases wine, it is perceived that the more expensive the wine costs, the better the wine must taste. This has been proven untrue in blind taste tests over and over again. Many great wines are available for minimal cost. Similarly, it is unfortunately perceived that higher investment fees equate to better investment performance and a higher level of service. Paying more in the investment world does not equate to actual better results.

The crux of it all is that investors seek perceived value when what they really want is actual value. The more complex an investment product or investment service, the more it is perceived to be offering greater investment value. And, the less complex an investment product is, the more actual value it offers. Think of it like this: The great PhDs and Nobel Prize-Winning Laureates at Long Term Capital Management in late 1990s created a very, very complex investment product of perceived great value that failed (and nearly single-handedly cratered the investment world at the time). Since Long Term Capital Management’s failure, the less complex index fund has proven to produce actual value. The more complicated something is, and the higher fees it has, the more likely it will end up underperforming and being a problem.

So, there you have it! Experts are declaring Virginia “One of the top 10 Great Places to Retire for Wine Lovers” and asking “Is Virginia Wine Country Poised To Be The East Coast Napa?“ so you’re picking the right place to be. So, go and enjoy your Vineyard Retirement in Virginia, but continue to discuss what I have referenced above. Because, according to the following, if you discuss these facts, you will remember 70 percent of them.

We learn: 10% of what we read; 20% of what we hear; 30% of what we see; 50% of what we both hear and see; 70% of what is discussed; 80% of what we experience personally; and 95% of what we teach to someone else.

For more advice from Sean Miller, see these 4 Questions to Ask an Investment Manager. ~

SEAN MILLER lives in Charlottesville with his wife and two teenage daughters. He and his family frequently visit the local vineyards and would love to see you there. Sean can be reached at 434-825-0000 or [email protected]. For more information go to www.millerasset.com.