Choosing an investment advisor is an important decision and one that will reap benefits. You not only need to be able to trust this individual but also want to make sure their qualifications and practices fall in line with your needs and financial goals, regardless of whether you are looking for assistance in retirement planning, investment planning, estate planning or comprehensive financial planning.

Finding a good financial advisor can help you focus on your monetary goals and provide you with greater portfolio returns at lower risk levels via better organization and record-keeping. We asked Chief Investment Officer and Portfolio Manager Sean Miller of Miller Asset Solutions LLC to share four important tips for interviewing and choosing the best financial advisor for your family.

How to Choose an Investment Advisor

The first and most critical decision is to choose a Registered Investment Advisor (RIA). Registered Investment Advisors are legally required to act as a fiduciary, which means they must place the client’s interests first and foremost. In other words, RIAs must invest your money in the most simple, low-fee, tax-efficient manner possible. Registered Investment Advisors also distinguish themselves by the following:

- OBJECTIVE INVESTMENT RECOMMENDATIONS. RIAs are not required to sell you, the client, an expensive proprietary bank investment mutual fund (or similar bank product). Instead, RIAs can more suitably and efficiently allocate your investments into investments with no cost and likely higher returns.

- “SKIN IN THE GAME.” An RIA has “skin in the game” when the majority, or all, of their investment assets are invested similarly (if not identical) to the investment of client assets. Specifically, the client and manager incentives are completely aligned, which ultimately lowers the chance of any conflicts of interest as well as leads to greater trust. RIAs with “skin in the game” not only perform better but also are more accountable.

How to Build a Diversified Portfolio

When seeking an investment advisor—and specifically an RIA—you should ask the following questions:

Question: Can You Please Explain All The Fees Charged to My Investment Assets?

Answer You Want: The industry standard is to charge clients 1 percent on investment assets. This equates to $1,000 of fees per $100,000 of assets, or $10,000 of fees per $1,000,000 of assets. Additionally, trading fees, mutual fund management fees and exchange-traded fund management fees should also be added up. Banks are notorious for charging you the 1 percent management fee plus the mutual fund management fee on that bank’s proprietary mutual fund. In other words, fees can exceed 1.75–2.00 percent at banks, which is simply too high for marginal investment management.

Question: Who Selects and Implements The Investments for My Assets?

Answer You Want: The Portfolio Manager is the title given to folks who select and implement (trade) your investment assets, but oftentimes they are not the one with whom you speak. You want as few folks between you and your assets as possible, because each person is a cost. Truly efficient management is speaking to the person (the portfolio manager) who actually manages your assets. This is why you want a Registered Investment Advisor.

How to Protect Your Wealth in an Unpredictable Financial World

It is important to have a “diversified” portfolio, but many often wonder what percentages of investments (known as “allocation”) should be put towards stocks versus bonds, and the current financial climate’s effect on that allocation. A diversified portfolio through asset allocation can be achieved by (a) estimating the maximum loss you would theoretically tolerate, and (b) sizing your positions properly.

Estimating Loss Tolerance

Traditionally, a portfolio composed of 60 percent stocks, or equities, and 40 percent bonds, or fixed income, is the bedrock of a properly diversified portfolio. However, the prices of bonds have been increasing over the last 15 years due to the decline of interest rates, which means the income from bonds has decreased over the same time period.

Specifically, the prices of bonds and the interest they pay have an inverse relationship (when the price goes up the yield goes down and vice-versa). Therefore, investors have been putting an ever-increasing amount of their “diversified” portfolio into equities.

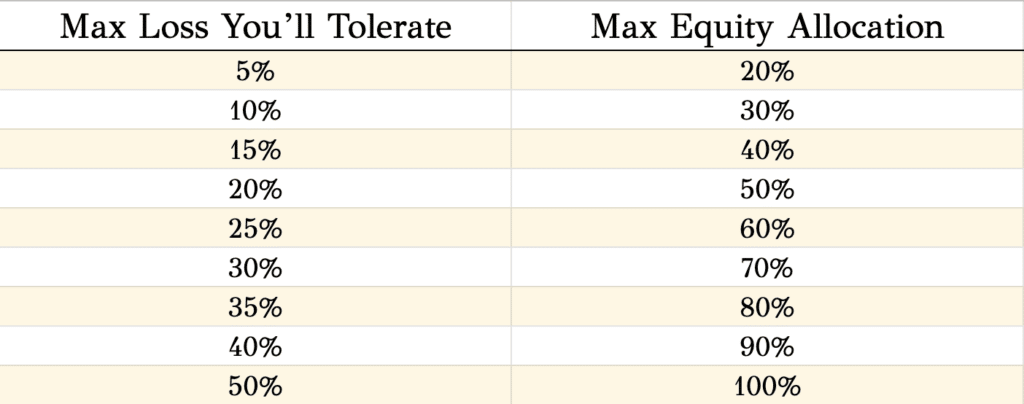

In the graphic below, you can see how “Max Equity Allocation” on the right corresponds to “Max Loss You’ll Tolerate” on the left. Indeed, a standard equity allocation can reasonably include both small capitalization stocks and emerging markets stocks (both of which are traditionally more risky than U.S. large capitalization stocks), where a 25% loss would result at an approximate 60 percent equity allocation.

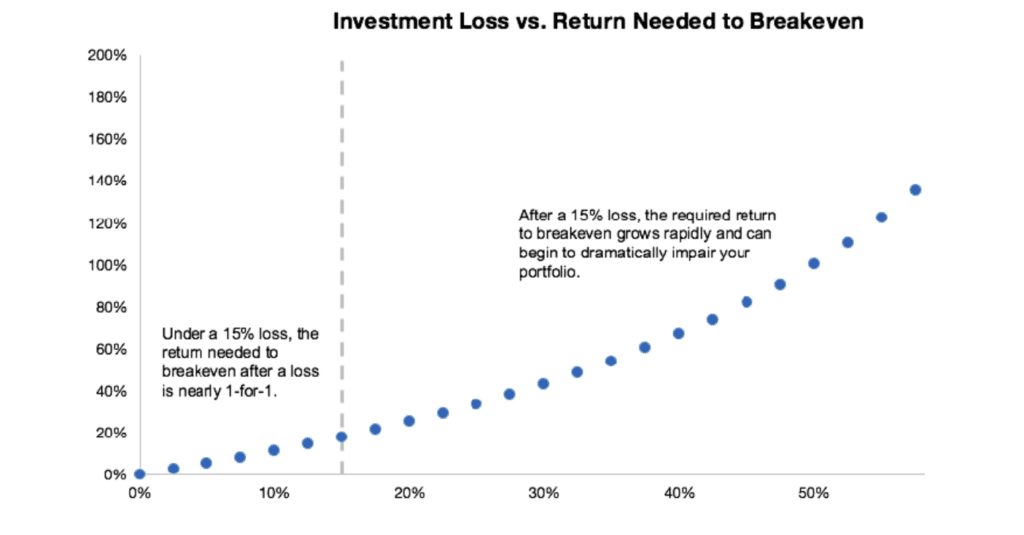

Additionally, one needs to understand the amount of loss they can tolerate in a down market scenario (such as the one we are currently in). The following graphic depicts that up to 15 percent, the return required to break-even is nearly 1-to-1 So, you need an 8 percent gain to recover an 8 percent loss and a 15 percent gain to recover from a 15 percent loss. A loss greater than 15 percent will require an even greater gain. For example, 25 percent loss requires almost a 40 percent gain to break even. Investors need to understand this principle well when diversifying their portfolio.

Estimating Position Size

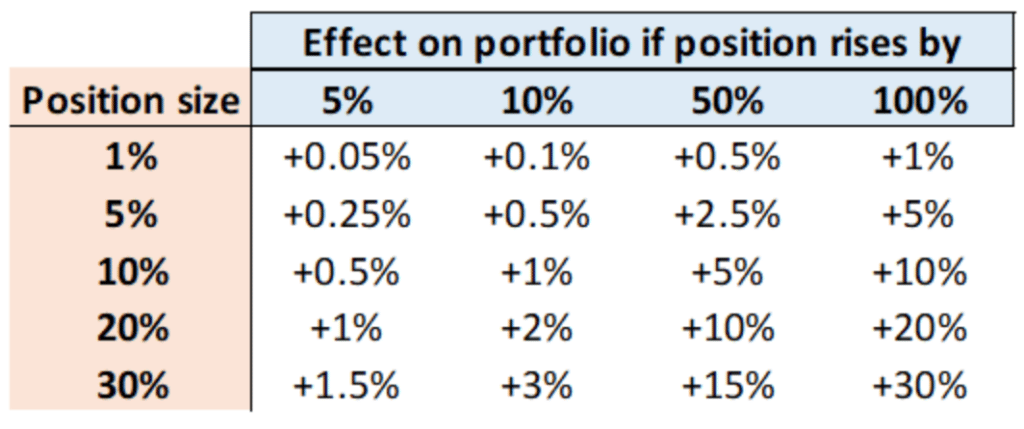

The above two graphics addressed the downside of too much equity concentration. The below graphic addresses the decision to have too little equity concentration. For example, if you decide to only allocate 20 percent of your diversified portfolio to equities (with 80 percent to a combination of fixed income and cash), then your return will never surpass 20 percent, and that is assuming that equity position increases by 100 percent. Additionally, a 20 percent equity allocation and a more reasonable (and historically accurate) average annual gain of 10 percent will only see up to a 2 percent increase. Thus, it is important to properly allocate to equities so your portfolio can realize sustained growth.

How to Diversify Your Assets

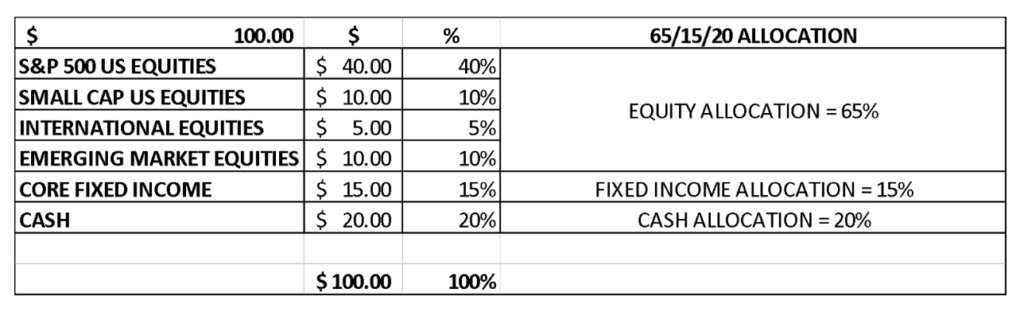

If you’re concerned with properly diversifying your assets given the current investing climate, choosing an investment advisor is all the more important. If a client came to me with $100 today with all of the foregoing discussions on risk, I would allocate it as follows:

One does need equity allocations to S&P 500 U.S. Equities, as well as Small Cap U.S. Equities and both International and Emerging Market Equities. Fixed Income offers little value currently but is worth a 15 percent allocation. I suggest an approximate 15–20 percent allocation to Cash to not only preserve portfolio value but also provide liquidity for the purchase of securities when they go on sale (when markets go down).

The bottom line is that investment markets require cautious and calculated risks. We all want someone we can trust and who will help us achieve our financial goals while financially protecting our investments. Miller recommends finding a Financial Advisor who manages “in the most simple, low-fee, efficient manner possible with an absolute adherence to fiduciary best practices.”

For more wealth management tips from Sean Miller Asset Solutions, see A Vineyard Retirement in Virginia. ~